Lecture 9 - Part 2

Graphical patterns analysis

Continuation patterns.

Graphical configurations which we will be considering, are called continuation patterns. Such models usually means that period of price stagnation reflected at the chart, is not more than pause in the trend development and trend direction will be the same after their completion. This is the major difference between the reversal patterns, which reflect the fracture of the main trend, and continuation ones.

Another criterion of difference between the reversal and continuation models is duration of its formation. More time is spent for the formation of the first patterns which show cardinal changes in price dynamics. Continuation models are short-term patterns. They should be correctly called intermediate.

TRIANGLES

Let us start with triangles consideration. There are three types of triangles: symmetrical, ascending and descending. All of them are different by shape and have different forecasting functions. One moment should be underlined that often triangles are the last correcting formation which precedes the cardinal top or bottom completing the trend. While this model forming you should carefully estimate the chart for the possibility of the main trend end approaching.

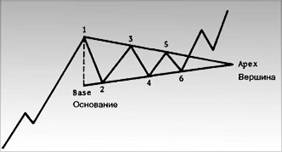

The main varieties of this pattern are shown at the pic. 1 a-c. Symmetrical triangle (pic.1a) is formed of two convergent trend lines where the top line is going down and the bottom line is going up.

Vertical line from the left, which determines the height of the model, is called base. The cross point of two lines from the right is called apex. Symmetrical triangle is also called spiral by the simple reasons.

Pic. 1a. Schematic image of the symmetrical triangle

Pic.1 – 1a. Pay attention that triangle is the last consolidating formation before the top forming

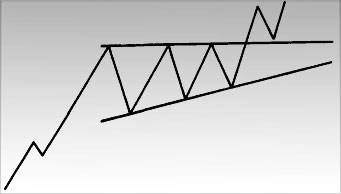

Pic. 1b. Schematic image of the ascending triangle

Pic. 1 -1b. Ascending triangle in the short timeframe formed before the completion of the short-term trend

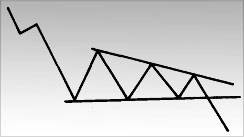

Descending triangle (pic. 1c), on the contrary, has horizontal bottom and falling top lines.

Pic. 1c.

Pic. 1 – 1c. Descending triangle warned about the forthcoming completion of the 2-weeks bearish trend

Triangle formation signifies the pause in the present trend, after which the last on is renewing. For instance, at the pic. 1a the previous trend was ascending and after the price consolidation in the shape of triangle, their development will continuing. In case of descending trend symmetrical triangle would signify that after its completion, price falling will resumed. The minimum requirement for every triangle is presence of four point of control. For drawing the trendline as we remember it is necessary to have 2 points. So to draw two convergent trend lines each of them should goes at least through the two points. At the pic. 1a triangle starts forming in point 1, it means where the uptrend consolidation forms. Prices are falling to the point 2 and then go up to the point 3. However point 3 is lower than point 1. Upper trendline can be drawn only prices will fall from the point 3.

Pay attention to the fact that point 4 is higher than point 2. Lower ascending line can be drawn only when the prices will go up from the point 4 in the course of market animation. Only after this moment analyst understands that it is symmetrical triangle. Now we have four points of control (1, 2, 3, 4) and two convergent trendlines.

Signal of pattern completion is given when the closing price coming out one of the trendlines. Sometimes backstroke of the prices to the trendline is observed after the break through. Depending on the trend direction – ascending or descending - this line becomes support or resistance level. After the break through, the top serve as an important support or resistance level. Criteria of the intersection while the break through can be different, in these cases minimal criterion of intersection is closing price fixed out the bounds of the trendline but not the simple intraday intersection.

Trading rules are the same for all the triangles. It is better not to trade upon the insignificant fluctuation inside the triangle, of course, if this triangle is small. As triangle is older price fluctuations become fewer. Profit is decreasing, and shift and commissions are continuing eating your balance as before. That is why the best variant is to buy or sell while the breakthrough upwards and downwards of triangle trendline in direction of the main trend. Stop-losses should be placed upper or lower of the breaking trendline.

There is a method allowing determining the price guideposts which market will reach after the triangle completion.

The way of determination is rather simple. Measure the height of the model in the widest part and project this distance upward or downward (depending on the direction of the trend). Level derived as a result of projection will be the point of price guidepost.

FLAG AND PENNON

Flag and pennon are very widespread on charts of financial market. They are being considered together because of their similarity. These configurations form at one and the same area of trend development, they have the same indicators of trading volume and their determination is also similar.

Flag and pennon signify the short pauses in dynamically developing trend. Steep line of price movement should precede formation of these models on chart. They designate the markets which outrun themselves in their development upwards or downwards and should stop for a while before they start moving in the same direction.

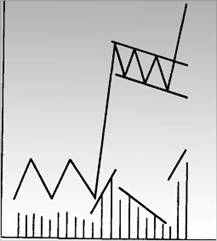

Flags and pennons are the most reliable patterns of continuation trend. Reversal trend occurs seldom in these patterns. Look at the example (pic.2) and see how similar these models are. Pay attention to the quick price rising with a big volume, preceding the model formation, and also swift activity decrease during its formation which gives signal about the market consolidation. Then activity is quickly increasing after the top trendline breakthrough.

Pic. 2. Bullish pennon. It reminds a small symmetrical triangle. Such model forms by the small volume. Price movement after its completion must repeat the distance passed by prices before the model appearance.

Formation of these two models is almost the same. Flag reminds the parallelogram or rectangle limited by two parallel trendlines with incline to the opposite side of dominant trend. In downtrend flag should be directed upward a little. Pennon model can be determined by two convergent trendlines and more horizontal position. Pennon reminds a small symmetrical triangle but differs by the scale: if triangle is forming by several swings of chart movement, then for pennon formation several candlesticks are needed, which form a little triangle. Flag forms by several candlesticks placed parallel in shape of oblong width.

Both models are rather short-term. While the downtrend they need less time to form than while the uptrend. Completing of both models occurs while the crossing of the upper trendline during the uptrend. Breakthrough of bottom trendline indicates the downtrend resumption.

Pic.3. Bullish and bearish flags and pennons. After breakthrough of the trendline movement is resuming in the direction of main trend.

Sharp foregoing pulse is obligatory for flags and pennons’ formation; it makes some “flagstaff” which the models stand upon.

There are also ways of price guideposts determination exist, which will be reached when the model is completed.

Ways of determination for both patterns are similar. Flag and pennon models like “fly up from the flagstaff to the middle of the mast”. It means flag or pennon are placed in the middle of price rising or falling.

In aggressive trading trader takes all the distance which price exceeded before a model formation as a guideline, and in a careful trading 50% of the distance is taken.

Opening positions is recommended after the process of pattern formation is completed, after the breakthrough of trendline limited the body of the model, in the direction of the main trend.

Test questions

- Name the types of triangles.

- What is the criterion for completion of triangle formation?

- What is the difference between the pennon and flag?

- Suppose that market movement upwards before the flag forming was 80 points, completion of pattern formation is breakthrough of level 1.2540. Determine the price guideposts which the market will continue rising up to.

- Indicate on charts of trading terminals the continuation patterns considered in thios lecture.

- What are the rules of trading for triangles?

- What is the signal for positions’ opening while the pennon and flag patterns’ formation?

The list of recommended literature:

English

English  Arabic

Arabic