Lecture 10

Candlesticks Analysis

At this lecture we will get acquainted with one more method of technical analysis called candlestick analysis. We have already considered how the candlesticks are build and what parameters are used for it at one of the previous lectures. Now we will discuss what possibilities for market forecast these combinations analysis gives. The thing is that different candlestick combinations can indicate the changes in market psychology and trend direction. These combinations are called patterns and, as graphical models, they are divided into reversal patterns and continuation patterns. Let us discuss first the reversal patterns.

REVERSAL PATTERNS. “HUMMER” AND “HANGING MAN”

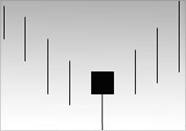

Candlesticks with long lower shadows and short bodies are shown at the picture 1 a-b. Real bodies are placed at the top part of daily price range. Striking feature of these candlesticks is the fact that they can be bullish or bearish depending on what phase of trend they appear in. Appearance of named above candlesticks in the downtrend is a signal that its domination is over. In this case candlestick is called “hummer” (see pic. 1a).

Pic. 1a. Schematic image of “Hummer” candlestick

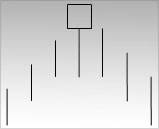

If a candlestick which is presented at picture 1 b, appears after the price rising, it can be a signal of its possible completion. In this case the candlestick has an ominous name “Hanging man”. It really reminds hanging man with dangling legs.

Pic. 1b. Schematic image of candlestick “Hanging man”

“Hummer” and “Hanging man” can be defined by three main features:

- Real body is at the top part of price diapason. Color of the body is not important.

- Lower shadow is twice longer than real body.

- Candlestick does not have upper shadow or it is very short.

The longer lower shadow is, the shorter upper shadow is, and the shorter the body, the higher potential of bullish “hummer” or bearish “hanging man” is. Though the bodies of these

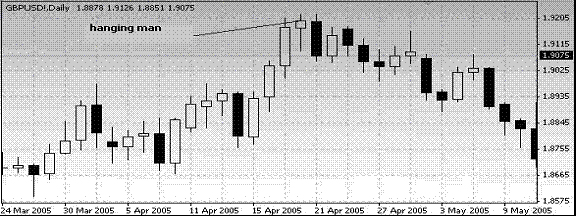

candlesticks can be white (unfilled) and black (filled-in), hummer with white body has pronounced bullish character, and “hanging man” with black body has pronounced bearish character. White (filled-in) body of the hummer signifies that prices were headily falling, then revival started, and closing price approximate to the maximal price of the session and became equal (pic.3). It indicates intensification of bullish tendencies. Black (filled-in) body of the “hanging man” dictates that closing price can not return to the opening price level. It is a feature of bearish potential increase. In case of hanging man appearance, it is better to wait for the confirming bearish signal. Events’ logic is the following: market is full of bullish energy. Then hanging man appears. At this day trades open at the maximal price level or near it, then price sharply falls and then rises again and close at the maximal price or near it. It is impossible to conclude that hanging man is a signal of reversal at the top by this price movement. Though such considerable price falling during one session indicates that preconditions for future reversal exist in market dynamics. So the main principle which you should remember in case of hanging man appearance, says: the more price gap down between the body of hanging man and the following day opening price is, the more probability of the fact that hanging man is forming a top. Black candlestick can be one more confirmation of bearish character of market. Closing price of this candlestick is lower than closing price at the day of hanging man appearance (pic. 2)

Pic. 2. Appearance of the black candlestick confirmed the formation of “hanged man” pattern and reversal of bullish trend.

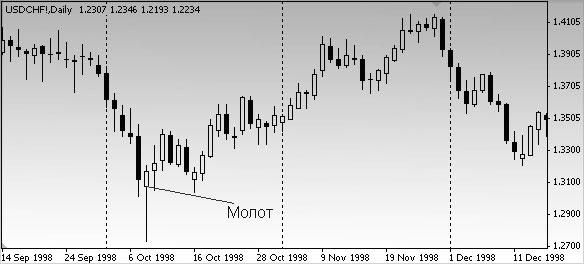

All said above is true quite opposite for hummer – big price gap upwards between the hummer body and opening price at the next day or white candlestick appearance which closing price is higher than the closing price at the day of hanging man appearance determines of high probability of the fact that hummer forms the bottom (pic.3)

Hummer

Pic. 2. Hummer which appears at the beginning of October determined the pause in bearish trend for more than two months.

ENGULFING PATTERN

Hummer and Hanging man are single candle patterns. However the most signals arise on the charts of candlesticks are based upon not the single candlesticks but upon their combinations. One of such combinations is engulfing pattern. It applies to the number of the most important signals of reversal and forms by two candlesticks with the bodies of different colors (pic. 4 a-b).

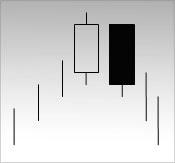

Pic. 4a. Bearish engulfing model. It forms at the ascendant market. “Engulfing” of white body of the candlestick by the black one is a signal of reversal at the top. In this situation it is obvious that bears take over the initiative.

Pic. 4b. Bullish engulfing model. Downtrend prevails at the market, then bullish candle with the white body appears, which as though engulf of the previous candle with the black body. It indicates that buyers’ pressure exceeds the sellers’ pressure.

Engulfing pattern must meet three conditions:

- Uptrend or downtrend (even short-term) should be strongly marked at the market.

- Engulfing pattern forms by two candles. The second body should engulf the first one (shadows can not to engulf).

- The second body must be contrast by color. So if after the long downtrend short black body is being engulfed by the long white body, it can be a signal of bottom reversal. And engulfing of short white body while the uptrend by the long black body can be considered as top reversal.

The factors are enumerated below which increase the probability of trend change after the engulfing pattern appearance:

- If the first candle of the model has short body and the second one – long, it indicates that the previous trend slackens, but new one is growing in strength (pic.5-6).

- If engulfing pattern appears after protracted or too swift trend. If trend lasts long, then all the potential buyers have already taken up long positions. In this case it is not likely to wait for big number of buying which is necessary for moving the market upwards. Fast price rising “protract” the market and makes traders to implement their profit closing positions (pic. 5-6).

-

Engulfing

If the second price of the model engulfs several bodies.Engulfing

Pic. 5. Engulfing at the top in June and February confirmed double top formation and gave signal about the beginning of prolonged bearish trend.

Engulfing

Pic. 6. Bullish engulfing at the end of July gave a signal about reversal and the beginning of bullish trend.

DARK CLOUD COVER

Next reversal pattern – “dark cloud cover” (see pic. 7a-b).This model consists of two candles appearing after the uptrend (or at the top bound of trading corridor), and signals about the reversal on top. At the first day candle with the long white body appears. Next day opening price exceeds the maximum of previous day (i.e. it is above than upper shadow of the first candle). However by the end of the day closing price approximates to the daily minimum and covers the major par of the previous candles with the white body. The lower closing price of the second candle (the more part of the white body is covered by the black body of the second candle), the more possibility of the top formation. Some candlesticks’ analysts consider that closing price of the black candle should cover more than 50 % of the white body. If the closing price of the black body does not reach this 50 % level, it is better to wait the next signals confirming probability of the bearish trend.

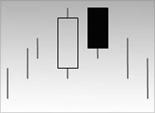

Pic. 7a. Schematic image “Dark cloud cover”

The list of factors which intensify significance of “dark cloud cover” pattern, are given below:

- The closer closing price of the black candle to the opening price of the previous white candle (the more part of the white body is covered by the black one), the higher probability of top formation. If the black body covers the previous white body completely, then bearish engulfing model forms. In “dark cloud cover” pattern black body just partly covers the white one, that is why “dark cloud cover” pattern resembles partly solar eclipse (i.e. only a part of preceding white body is covered) (pic. 7 b). Bearish engulfing model is complete eclipse of the Sun, covered the whole Sun (i.e. the whole white body is covered). Consequently, bearish engulfing model is stronger reversal signal. If long white candle formed with the closing price which is higher than maximums formed by the “dark cloud cover” or bearish engulfing model, new price rising is quite predictable.

- If during the long uptrend candle with long white body appears which opining price is equal to the daily minimum (i.e. it does not have lower shadow), closing price is equal to the daily maximum (i.e. it does not have upper shadow) and next day long candle with black body appears opened at maximum and closing at minimum, one can say that it is “black day with cut top and cut bottom”.

- If the second candle of “dark cloud cover” (i.e. candle with black body) opens higher than important resistance level and then price falls, it is a proof of the fact that banks cannot control the market.

Dark cloud cover

Pic. 7 b. “Dark cloud cover” – significance of the model intensified by the black candle covered more than 50% of the white candle body.

PIERCING LINE PATTERN

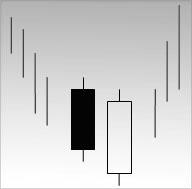

If “dark cloud cover” is a signal of reversal on top, then its opposite is “piercing line” pattern – signal of bottom reversal (see pic. 8 a-b). It consists of two candles and appears during the downtrend. First candles has black body, second one has long white body. White candle opens much lower than price minimum of the preceding black candle. Then price is rising forming rather long white body which closes upper than the middle of black candle body.

Pic. 8 a. Schematic image of “piercing line” pattern.

Bullish “piercing line” pattern is close to the bullish engulfing model. In bullish engulfing model white body fully covers the previous black body. In bullish “piercing line” pattern white body just partly covers preceding black body. The more part of the black body is covered by the white body, then bottom reverse is more probable. Psychological hidden motive of the “piercing line” model add up to the following: downtrend prevails at the market. Appearance of the bearish candle with the black body confirms its power. Next day opening price forms the gap downwards and appears lower than the previous minimal price. Bears are glad. Then prices start rising and by the end of trading day closing price not only becomes equal but considerably exceeds it. Significance of the “piercing line” pattern is determined by the same factors as of “dark cloud cover” model but in mirror image mode. In case with “piercing line” model, the rule of 50% covering of the previous candle must be more strictly observed than while the “dark clouds cover” model forming (pic. 8b)

Piercing line

Pic. 8 b. “Piercing line” pattern, pointed at the chart, can pretend to the status “ideal” – opening price of the white candle is lower than minimum of the previous one; real body of the black candle is covered in more than 50%.

STARS

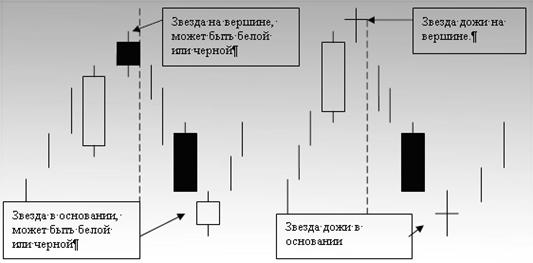

Stars are one of the most mysterious signals of reversal. Star is a candle with short body which forms the price gap with the preceding candle which has a long body (see pic. 9 a). The main condition for star formation is gap between its body and body of the previous candle, meanwhile shadows’ intersection is acceptable. Color of the candle is not important. Stars can appear at the bottom and at the top. If candle corresponds to doji, i.e. it has horizontal line instead of a body, it is called “star doji” (see pic. 9 b). Star, especially “star doji”, warns about probable completion of the previous trend. Small body of a candle indicates that exhausting fight between the bulls and bears came to a full stop. If strong uptrend prevails on market, situation is under bulls’ control. Star appearance after the candle with long white body while the uptrend is a signal that buyers’ rule at the market is over and adjustment between demand and supply. This balance is made conditional by pressure release of buyers or pressure amplification of sellers. Anyway star signals that potential of uptrend is exhausted and market change is probable. The same but in a mirror image mode is true for stars while the downtrend: star appearing right after the long black candle indicates about change of alignment of forces on market. If during the downtrend bears ruled at the market, situation changes after the star appearance: forces of bulls and bears become equal. Energy pressed down is weakening. Bears loose firm ground.

doji star at the bottom

The star at the bottom can be white or black

The star at the bottom can be black or white

doji star at the top

Pic. 9 a. Schematic image of “star” candle.

Pic. 9 b. Schematic image of “star doji” candle.Stars are compound of four reversal models:

- Evening star;

- Morning star;

- Star doji;

- Shooting star.

Body of the star can be white or black in these patterns.

MORNING STAR

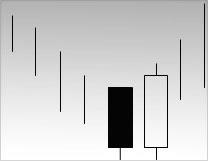

“Morning star” (see pic.10) is bottom reversal pattern. “Morning star” pattern consists of a candle with black long body which is followed by the short-bodied candle with the gap downwards (these two candles form the simplest model “star”). At the third day white candle arises, which body covers major part of first day black body. This pattern signals that bulls seized the initiative.

Morning star

Pic. 10. Reversal pattern “Morning star”. Model was affirmed by the strong white candle appeared after the star formation.

EVENING STAR

“Evening star” is a bearish double of the “morning star”. “Evening star” pattern is a signal of reversal at top, so it becomes a signal to actions only if it arise after the uptrend (pic. 11). “Evening star” consists of three candles. First two candles have long white bodies which is followed by a star. Star is a first hint of the market approaching to the top. The third candle confirms the top formation and complete the pattern “evening star” consisted of three candles. The third candle has black body which covered the major part of the white body of first candle.

Evening star

Pic. 11. Evening star model. After the long-term uptrend, formed “star” gave a signal about probable change of the trend.

Reversal models “Morning star doji” and “Evening star doji” are different from considered above patterns by the following feature. Instead of the candle with short body, candle is forming which opening price is equal to the closing price, which absence of the body arisen from. Another requirements for models’ formation are similar to the models “Morning Star” and “Evening Star”, but “Star doji” are considered to be more important because they conclude doji candle.

Basically all models composed of a star, should have price gap between the first and the second bodies and one more gap between the second and the third bodies. However as experience has shown, the second gap is seldom and not obligatory for this model successful work.SHOOTING STAR AND INVERTED HUMMER

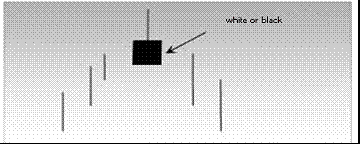

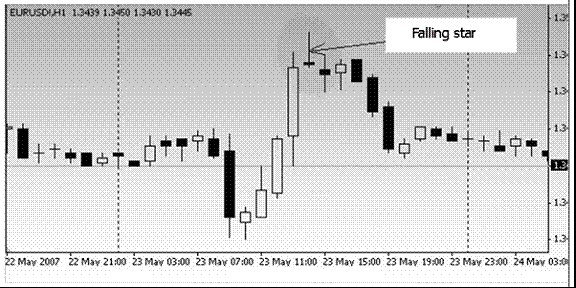

“Shooting star” is a model of one candle warning about the probable ending of price rising. Its appearance corresponds to its name. In contrast to the evening star, shooting star is not that important signal of reversal. As it shown at the picture 12, shooting star body is short and placed at the bottom part of price diapason of a candle; upper shadow is long. Like another stars color of the body is not important. Body of ideal shooting star makes a gap relative to the body of preceding candle. However as it will be shown below, this gap is not invariable.

Pic. 12. Shooting star

This candle demonstrates that trading session was opened close to the daily minimum, then price swiftly rocketed upwards and fell again so that closing price approximate to the opening price. In other words, price rising during the trading session appeared to be unfounded.

Pic. 13. After four-days immutable price rising, price swiftly shot upwards and fell again.

Along with reversal patterns, candlestick combinations, as it was mentioned above, can form continuation patterns. Let us consider some of them.

WINDOWS (GAPS)

Japanese call price gap “window”. If in the western graphical analysis ones use expression “to fill in the price gap”, then in Japan “to close the window” is used. Let us consider concept of “window”. Window is a price gap between the closing and opening prices of the current and preceding trading days (sessions). At the picture 14 opened windows in the uptrend are shown. Price gap appeared between the upper shadow of the previous candle and lower shadow of the next one.window

Pic. 14. Windows in the uptrend confirmed the price rising, but formed engulfing indicated change of power at the market.

At the picture 15 window in the downtrend is shown. There is no price fluctuation between the lower shadow of the preceding candle and upper shadow of the current day candle.

window

Pic. 15. Windows in the downtrend are like continuation patterns. Pay attention that trend reversal indicated by two reversal models – “Piercing line” and bullish “Engulfing” patterns.

Japanese analysts take up the position that trading should be opened to the direction indicated by the window. Windows also become resistance and support areas. So window in the uptrend is signal of further price rising. While the correcting falls this window should support the prices. If as a result of correcting fall window closes and sellers’ pressure remains, preceding uptrend is complete. Window in the downtrend signals about further price falling. Any correcting price risings will face the resistance at this level. If window closes and price rising which was the reason of its closing, then downtrend is over.

“THREE METHODS” PATTERNThere are two variants of this pattern: bullish model “three methods” and bearish model “three methods”. They are continuation patterns. The following elements comprise bullish model “three methods” (see pic. 16):

- Long white candle.

- After this white candle the group of falling candles with short bodies follows. Ideal model has three such candles but it can be two or more than 3. The most important thing is that they should not transcend the diapason of white candle prices. Short candles can be any color but often they are black.

- Last trading day should be presented by the long white candle with closing price higher than closing price of the first day. Opening price of the last candle in the model also should be higher than closing price of the preceding trading day. This model resembles bullish flags and pennants at the western graphical analysis. Pattern “three methods” is associated with the rest from trading or respite between the battles. Simply speaking, with appearing of short candles market stops for a “rest”.

Three method

Pic. 16. Model “three methods” in the bullish trend.

Bearish pattern “three methods” (see pic. 17) is forming in the downtrend. First of all, long black candle arises. It is followed by three short gradually rising candles (usually white), which are in the price diapason of the first candle (including shadows). Opening price of the last trading session should be lower than preceding closing price, and closing price – lower than closing price of the first black candle. After this last session presented by the black candle, price falling should continue. This model resembles bearish flags and pennons in the western graphical analysis.

Three method

Pic. 17. Model “three methods” in the bearish trend.

It is far from complete list of the patterns which include candlestick analysis method. We considered the most significant reversal and continuation models which are abundant at the market and giving the most reliable signals for analysis and decision making.

Test Questions

- Describe the major criteria of “Evening star” pattern determination.

- What is the difference between models bullish “Engulfing” and “Piercing line”?

- What is “three methods”? What prospects are expected in case of this concept appearance at the market?

- Owing to what trend “Morning star” model can be formed?

- “Dark cloud cover” pattern was formed and confirmed at the market. What position (long or short) you make a decision about opening of?

- Model “window” was formed in the uptrend, what actions will you make?

- close opened before long position;

- open short position;

- expand opened before long position;

- open long position.

The list of recommended literature:

http://instafxeducation.com/en/tech_analysis.php

English

English  Arabic

Arabic