Lecture 11

Wave Analysis. Elliott Wave Principle

In this lecture we will take a look at the basis of one of the best existing forecast instruments which is called «Elliott Wave Principle». «Wave Principle» - is a discovery of Ralph Nelson Elliott showing that the public behavour (or crowd psychology) improves and changes in the form of identifiable models. Using the exchange market data as the main instrument, Elliott discovered that ever-changing price configuration of the exchange market shapes up a certain structured pattern, which describes the fundamental natural harmony. On this discovery basis he developed a rational market analysis system. Elliott pointed out the move patterns or «waves» emerging again and again in the market price movements and they are self-similar in form, but not always in timeframe and amplitude. He entitled these models, gave definitions and illustrations. Thereafter, he described how these structures link together to form a zoomed version of these models, and then how they link for building-up the extended identical models etc. To be brief, the Wave Principle - is a catalogue of price adjustments models and explanantions of where is most likely to see such figures in the market development process. Elliott classifications represent themselves a rule set for the market behavour explanation. Elliott posited about prediction significancy of the Wave principle, which was called after its developer's name.

Essential concepts.

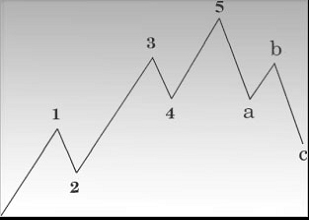

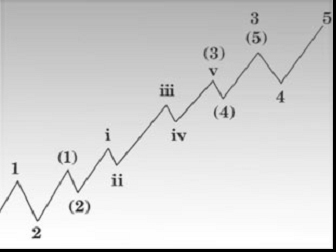

The main market cycle motion runs up according to the structure consisting from 5-wave sequence, which is corrected by 3-wave structure with the opposite direction (pic1).

Рiс. 1. Diagrammatic view of the Wave Principle.

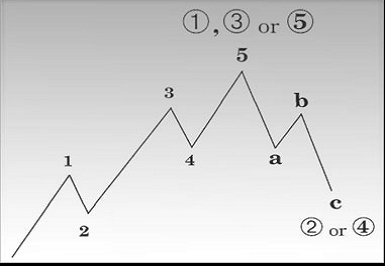

«Enumerated phases» called by R.N. Elliott as «cardinal waves» now known as «impulsive waves». «Sideward phases» nowadays - «corrective waves» or sometimes just «triplets». The wave 2 corrects the wave 1; the wave 4 corrects the wave 3. The full sequence of waves 1-5 is corrected by a-b-c sequence. Looking at the large scale image the wave sequence 1-5 shapes up a higher level wave. Thus, 1-5 wave movement completes the wave , and , while a-b-c sequecnce completes the wave or (pic.2).

Pic.2 Schematic wave diagram

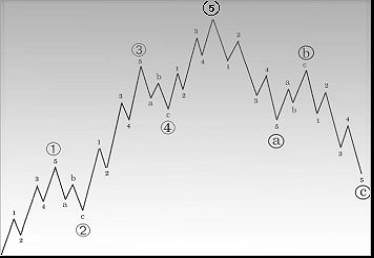

Inthemicroscale each wave at the pic.2 can be divided into small wave components:

- wave 2 corrects the wave 1;

- the wave 4 corrects the wave 3;

- a-b-c sequence corrects the the sequence of 1-5 waves (pic.3).

Pic.2a The EUR\USD pair graph

At the pic.2a at the EUR\USD currency pair graph we can see the Elliott full wave cycle. The main cycle waves are traced with the red line, yellow lines signal small wave components of the main waves.

Pic. 3 Wave fractionation into small wave components.

There are three rules which are «unbreakable»:

- Wave 2 never turns back ["reverses»] further than the wave 1. If the impulsive waves are up-directed, then the wave 2 can not slide below the 1 wave's start point (see the pic. 4). If the impulse sequence goes down, the wave 2 can not surge above the peak, from which took its rise the wave 1.

- The wave 3 can not be the shortest among the «impulsive waves» (see the pic.5). The wave 3 is not reqiured to be the longest, but it almost always it is.

- In the increasing sequence the wave 4 can not step out of the wave 1 peak range. In falling sequence the wave 4 rally can not tick above the wave 1. If even one of these rules is broken, the sequence is not impulsive (pic.6).

At the pictures 4,5 and 6 are shown the «wave markings», forbade by the principle.

Impulsive waves

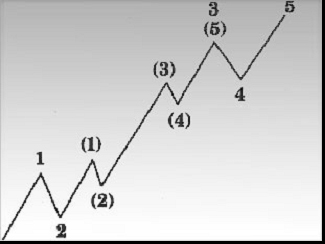

In one of the waves a variation may take place, known as extension. Extension — is exaggerated or overextended movements, which don't fit into the scale, compared to other impulse waves. Take into account that extensions can be only in one of the impulsive waves (in the 1st, 3d or 5th). More often these extensions occur in the 3d wave. They can also emerge in the extended wave.

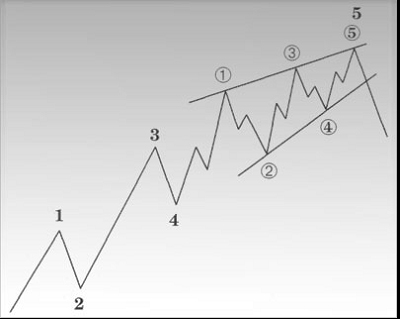

Pic. 7. Sequence from (1) to (5) the wave 3.

Pic. 8 Sequence from i to v - extended wave (3); it is the part of extended wave 3.

There is one more impulsive waves variety - diagonal triangle, wedge-shaped structure, formed by two concurrent lines (in their normal form). Such structures may be witnessed in the wave 5 position, usually after drastic and short-term motion of the previous wave 3 . Usually, in such wedge the sub-waves have a «triplet» or «quintuplet» form . A crossover between the 1 and 4 wave endings — is also frequent seen issue. It is the only well-known exception from the Elliott's «noncrossing rule» of 1 and 4 waves.

Example is given at the pic.9

Diagonal triangles can also be found in the C wave position, which is a part of the «sideward phase», i.e. in the corrective waves. As well as in case with wedges in the 5 wave position, these formations signal the movement ending, one level above the considered one.

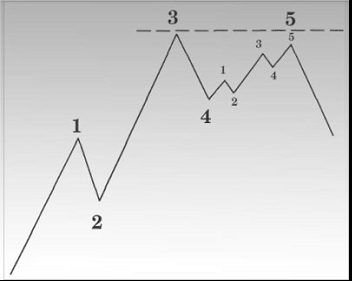

Pic.9. Wave 5 — diagonal triangle

Betweentimes, the 5th wave is not able to overcome the previous wave 3 ending level. A concept with this meaning is negatively inspired - «failure». You can make sure of such structure existence if the internal waves of the «failed 5th wave» correspont to all threee rules related to the impulse waves. Failure — is a reversal structure, which generated the «double tops» or «double lows» well known in the classical chartism. This structure is rarely seen at the «minutes» or «minors», but it is widely spread at the «minuettes» (pic.10).

Pic. «Double top» structure or «failure».

CORRECTIVE WAVES

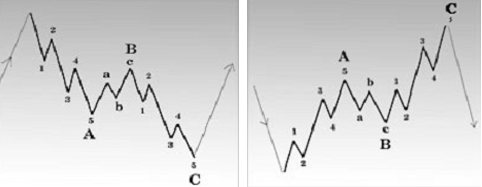

Movements, directed versus the trend are called «corrective waves» or just «corrections» (retracements). Sometimes, they are called as «consolidations» or «lateral phase». The only and the most essential rule, which can be conceived from different corrective patterns examination, is that the rollbacks can never turn into «quintuplets». Only moving waves are the «quintuplets». For this reason, the starting 5-wave motion against the older wave level is never a correction end, it is just a part of it. Correctional processes are carried out in two ways. Sharp kick-backs bend steeply versus the movement direction of the older wave level. Although the sideward corrections always carry out the total rollback from the preceding wave, usually they include a move to its starting point or even out its bounds range, shaping up a lateral movement facade. The separate corrective patterns break down into the main categories:

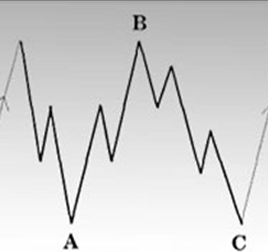

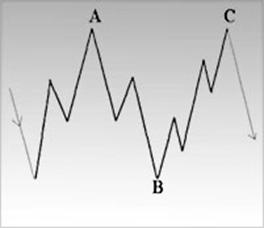

- Zigzags (5-3-5), (pic.11a-b).

Pic. 11a. Zigzag Bull correction

Pic. 11b. Zigzag Bear correction

Pic.12b. Flat Bear correction

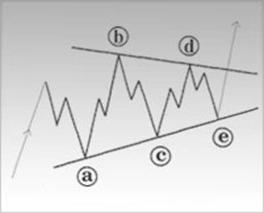

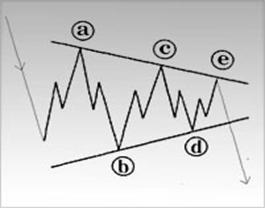

- Triangles (3-3-3-3), (pic. 13a-b)

Pic. 13a Triangle Bull correction

Pic. 13b Triangle Bear correction

This standard patterns combination constructs the 4th category.

- Double triplets and triple triplets (combined structures)

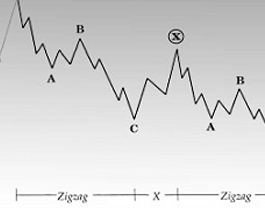

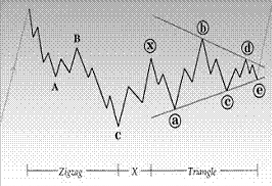

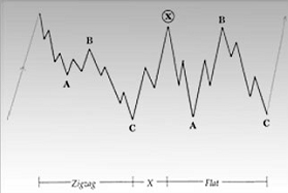

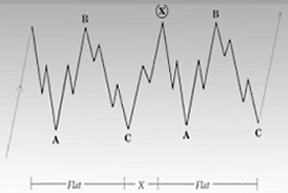

a) Composite corrective forms Double triplets Flat-complex (pic.14a — e).

Pic.14a. Zigzag-|-Х-|- Zigzag.

Pic. 14b. Zigzag-|-Х-|-Triangle

Pic. 14c. Zigzag- |-Х-| -Flat correction.

Pic.14d Flat correction- |-Х-| - Flat correction

b) Composite corrective forms

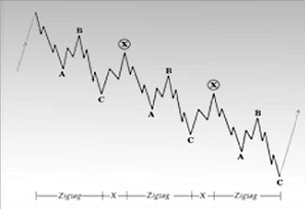

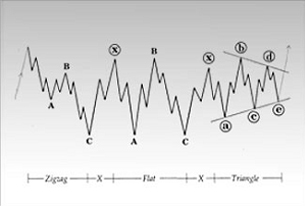

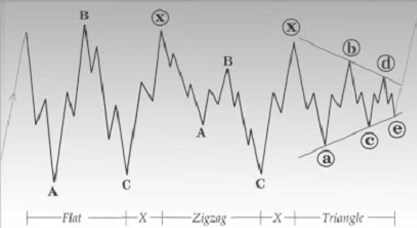

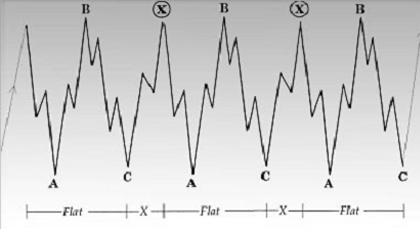

Triple triplets (pic.15a-d)

Pic.15a. Zigzag-|-Х-|-Zigzag-|-Х-|-Zigzag.

Pic.15b Zigzag-|-Х-|-Flat correction- |-Х-|-Triangle

Pic.15c. Flat correction-|-Х-|-Zigzag-|-Х-|-Triangle

Pic.15d. Flat correction-|-Х-|-Flat correction-|-Х-|- Flat correction.

You must have already drawn attention to that the basic patterns in double and triple triplets are linked by wave X, which also turns out to be a triplet (corrective wave) and it may be a flat, zigzag and triangle.

Alternation Principle

Despite its sounding title, the alternation principle — is exactly a principle, i.e. a valuable norm, but not a changeable rule in the Wave methods. The market experience shows that the principle is valid during 90% of time between the waves 2 and 4 in 5-waves structure.

In the statement made by R.N.Elliott, the principle requires the alternation in emerging of simple and composite correctional structures in the waves 2 and 4. A simple deep correction (zigzags, double zigzags) in the wave 2 must construct a composite sideward one (flat, triangle, double and triple triplets) in the wave 4.

However, in Forex market the Alternation principle is rightful mostly concerning the extent, not the structure of the corrections. For instance, if wave 2 rolls back by 61.8% or more from wave 1, mostly likely that wave 4 would pull back by 38.2% or less from wave 3.

If wave 2 rushes back by 38.2% from wave 1, then wave 4 will correct wave 3 by 23.6% or 50%. The opportunity of structure alternation still remains, but from time to time there may emerge significant exceptions. More often, the alternation process comes about the extension or deepness of the corrections, rather than about their structures and forms.

This principle also requires us to look for different formations in double and triple triplets. In the double triplet the most commonly used structure is a flat correction or zigzag. If the triangle is shaping up, it almost always appears to be the last structure in the correctional phase. Two sequent flat corrections signal that there will be the third one, ordinary — a triangle. A triple triplet may be constructed from three flat corrections. The Theory reqiues to search in the triangle different structures in tangent and integral subwaves. Subwave A is not similar to subwave B; subwave B differs from subwave C etc.

FIBONACCI RELATIONSHIPS

Elliott noticed in his work «Nature's Law» that Fibonacci seqence is a small basis of the Wave Principle. Here are Fibonacci figures: 1, 1, 2, 3, 5, 8, 13, 21, 34, 55, 89, 144, 233, 377, 610 etc.

The sum of any two neighbor figures is equal to the next figure in the sequence. Example: 3 + 5 = 8; 5 + 8 = 13; 8 + 13 = 21; 13 + 21 = 34 etc. Dividing of Fibonacci figure by the neighboring lesser one gives 1.618. Example: 34/21=1.618. Further, the same Fibonacci figure dividing by the next one gives 0.618. Example: 34/55 = 0.618. The figure opposite to 1.618 is equal to 0.618. Likewise, the contrary to 0.618 is 1.618. Example: 1 /0.618 = 1.618, и 1 / 1.618 = 0.618. Dividing of any Fibonacci figure by the previous one by two positions in the sequence increases the result to 2.618. And this figure dividing by the next one, which is in two positions from it in the sequence, amounts to 0.382. Example: 55/144 = 0.382. A contrary figure to 2.618 is 0.382, and the figure opposite to the proportion 0.382 is 2.618. Example: 1 /2.618 = 0.382; 1 / 0.382 = 2.618. Any Fibonacci figure dividing by the figure which is 3 positions before it, gives 4.236. Example: 144/34 = 4.236. And the same figure diividing by the next one, 3 positions away from it in the sequence, gives a reading of 0.236. Example: 144/610 = 0.236. The opposite figure to 4.236 is equal to 0.236, and the figure opposite to the proportion 0.236 is 4.236. Example: 1 /4.236 = 0.236; 1 / 0.236 = 4.236. A proportion which equals to 1 (par) shows the equality relation between first two figures in the Fibonacci sequence; thus, 1/1 = 1. Relation 0.5 appears as the second and third figures ratio in the sequence, therefore, 1/2 = 0.5.

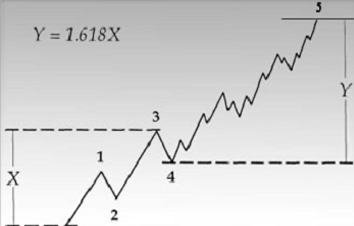

Fibonacci figures don't have any value during the market movements «extension» forecast regarding the absolute price value. The key elements — relations between the sequence figures. More frequently and reliable the Fibonacci figures can be seen between the alternating waves, rather than between the neighboring. As an example, the wave 3 length in the 5-wave structure is influenced mostly by the wave 1 length, rather than the wave 2 length. The target orientators counted by means of Fibonacci relationships usually turn out to be essential support or resistance levels, even if after that follows their break through. An important addition to Elliott Wave Principle appears to be a comprehension that Fibonacci proportions are the «initial determinants», measuring the price «duration» through time in the market. Elliott Wave Principle provides us the form and structure and Fibonacci relationships give an instrument for measuring any price movement potential, including the limitsof possible finishing date of these movements. This a very powerful combination.

Let us look through more detailed how Fibonacci ratios behave during the wave formation.

Impulse waves

The ending point of wave 3 — the hardest to predict, compared to three impulse waves. As the 3d wave may be shorter than the 1st one (rather seldom), then its closing forecast — is a real trap for an imprudent analyst.

If it is shorter than wave 1, wave 3 may equal to wave 1 or be longer by 1.618. In case of extensions, wave 3 may be longer even by 2.618 and 4.236 than wave 1.

The length of wave 5 can be obtained by means of Fibo ratios, used for price movement between the opening of wave 1 and closing of wave 3. A typical ratio in 5-wave structure is: wave 5 equals to 0.382 and 0.618 from the difference between wave 1 opening and wave 3 closing. Very often, wave 5 happens to be longer than wave 1 by 1.618. In these ratios is considered that waves 1 and 3 are extended.

Extensions

In each 5-wave structure worth taking into account that only one from the impulse waves (1st, 3d or 5th) will be extended. If wave 3 is extended, then waves 1 and 5 have the equality tendency on a price distance or equality tendency on movement length from the opening point to the closing one. In case of extension the middle of «wave 3 within wave 3» usually points at the central point of all wave 3 movement. A mysterious thing as extension still remains one of the least clear matter in the Wave Principle. If we see a serie of overlapping waves in such wave structure point, where is not considered a presence of horizontal and diagonal triangles — usually it is an extension. In Forex markets about 60% of extensions appear in three forms. Extended 5th waves can occur in 35% and left 5% - extended 1st waves. If an extended wave is found in the first 5-wave structure, so the next correction of all structure should be expected around wave 2, instead of regular wave 4 range. It is especially correct in case when wave 5 is much less than wave 3 in the sequence.

Within the extensions the corrections are smoother. A normal percentage of reversal against the previous wave is – 23.6%; the corrections rarely exceed 38.2%. If wave 2 pulls back from the 1st one less than by 50%, most probable is that wave 3 will be extended. Such tendency becomes more possible if wave 2 structure is similar to flat and irregular correction. If wave 5 in any 5-wave structrure is extended, then about 80% of cases this structure is wave 3 in larger formation. If wave 5 is extended — its length is often bigger by 1.618 than the full price distance between the wave 3 opening point and wave 3 peak. See the picture below:

Pic.16 A schematic description of wave 5 extension.

Corrective waves

Methods used during the predictive modeling of corrective waves deepness according to the Elliott Wave Principle may be various, though the main approach to applies to multiplication of Fibo ratios 0.236, 0.382, 0.5 и 0.618 by the preceding impulse wave length.The corrections have an inclination to price reversion to the range of the previous wave 4, at lower rate — frequently, a little bit further than its extremum. Elliott named 8 types of correctional structures and found out that they can double or triple in the long-term lateral consolidations. A double triplet — the most complicated correctional structure within the Wave Principle. That is almost the one and the most widespread reason for mistakes in the forecasts and temporary targets. (pic.a — f). The double triplets are not frequently occured in higher rate waves, however, it is not a rarity at 1-hour and 10-minutes chats. If the correction starts from a compound sideward structure (flat correction or triangle), then the rollback from the dominating impulse trend usually confines itself to the deepness of 38.2% or at the very outside - 50%. Generally, it is correct even if this correction is wave 2. A correction, which doesn't run beyond 38.2% of the previous motion signals the restraining power of the major trend. Identically, a consolidation, reqiureing time for closing, it is a curtain-raiser prior to the crush, which will take place after correctional structure ending. 50%-corrections in the 5-wave structures — is an everyday occurence, but they happen not so often as 61.8%-corrections. But 50%-corrections are frequent seen in the Rally internal waves taking place in the bear market, i.e. inside the wave B in the zigzag. The end of zigzag doesn't guarantee that the whole retracement has finished, as the «rollback» forms may contain complicated structures. But the analyst has to follow the most straightforward explanation of completed structure. R.N.Elliott also affirmed that the most simple structure often appears to be a correct interpretation. Elliott did not try to give exact prediction rules for longer correctional structures. In «double zigzag» structures the secong zigzag must close significantly lower than the bottom bound of the first one (in the bull market). And, on the contrary, in the falling market the second zigzag must close much higher than the first zigzag peak.

The Wave Principle doesn't give an opportunity to predict the wave 2 ending point. Unfortunately, even reliable Fibo ratios are useless. Hereby, Elliott can offer only verisimilar points, where can be put the Stop levels. That is why it's better to avoid trading in the second waves. Oftener, the second waves are simple (zigzag, double zigzag), and the fourth waves — are complicated (flat retracement, irregular correction, triangles, double or triple triplets etc.). Wave 2 usually «pulls back» deeper than the 4th one. Wave 2 has a rollback trend to 61.8% or furhter against wave 1. If that does not happen — the next most likely reading is 50%. The most typical rollback deepness of wave 4 equals to 38.2% from wave 3. In case of wave 5 «failure», can be expected that the next deepness retracement will turn out to be the most possible for a correctional structure.

Pic.17 demonstrates a typical rollback deepness of wave 2.

Pic.18 demonstrates a typical rollback deepness of wave 4.

Fibonacci correction levels are counstructed as follows. First of all, between two extreme points is traced out the trend line — for example, from the bay to the opposite top. After that, are designed 9 horizontal lines, crossing the trend line at Fibonacci levels: 0,0%, 23,6%, 38,2%, 50%, 61.8%, 100%, 161,8%, 261,8% и 423,6%. (Due to selected scale some of these lines may not fit at the graph).

After a strong rise or fall the prices often reverse back, correcting a huge part of its origin movement. During such reversal motion the prices frequently meet the support/resistance at Fibonacci correction levels or around them.

Fibonacci proportions comprehension: the first pullback level (23.6%) is usually insignificant, the next level (38.2%) - as a rule, it is a substantial level, the market rolls back from it almost all the timel; if the market reversal goes on afterwards — the next essential consolidation level will be at 50%, and the pullback continuation to 61.8% usually signals a final closing of the preceding trend.

Test questions:

- Name the basic corrective patterns.

- List the obligatory rules, which must be followed during impulse waves formation.

- Find and mark up at any currency pair graph the full Elliott wave cycle? Send a graph screenshot.

- What is called an alternation in the Elliott Wave Principle?

- What the strongest support and resistance levels do you know, according to Fibonacci ratios?

- At any currency pair graph trace out the Fibonacci lines. Take notice how behaves the price graph in relation to % Fibo levels. Describe the features.

List of recommended literature:

http://instafxeducation.com/en/elliott_wave_theory.php English

English  Arabic

Arabic